Why PayLow Pro Surcharge Works for Your Business

Surcharging allows your business to pass a small, clearly disclosed percentage of the credit card processing cost to customers who choose to pay with a credit card. Instead of raising prices for everyone, you can give customers a choice: pay with a credit card and incur the small surcharge, or choose another payment method without it.

Automated Card-Type Detection

PayLowPro’s systems automatically detect eligible credit cards and ensure surcharges are never applied to debit or excluded card types, eliminating compliance risk.

Recover Processing Fees Without Raising Prices for All Customers

Unlike blanket price increases, surcharging lets you offset the cost of credit card acceptance only when customers choose that payment method.

Transparent, Customer-Friendly Experience

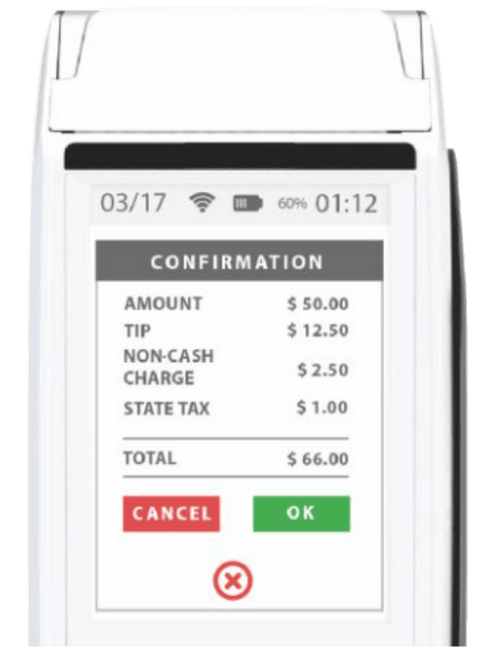

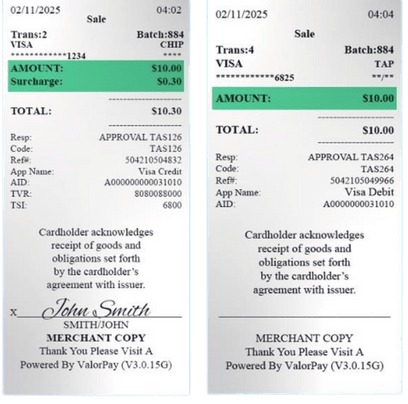

Surcharge amounts are displayed clearly at checkout and on receipts, giving customers full visibility and choice.

Compliant With Card Brand & Legal Rules

Our program automatically helps you meet regulations, including card network rules about surcharge limits and disclosures. The surcharge you set must:

- Be equal to or less than your actual cost of card acceptance (capped at a legal maximum, typically 3%)

- Apply only to credit card transactions — not debit, HSA, prepaid, or other payment types

- Be clearly disclosed at the point of entry, point of sale, and on receipts

- Return the surcharge proportionally on refunds when necessary.

Automated Card-Type Detection

PayLow Pro’s systems automatically detect eligible credit cards and ensure surcharges are never applied to debit, HSA cards or excluded card types, eliminating compliance risk

Business Benefits of the PayLow Pro Surcharge Program

Recoup a significant portion of credit card processing costs

Avoid across-the-board price increases

Maintain customer trust with clear disclosures

Reduce pressure on your margins in a competitive market

Many businesses experience substantial savings once a compliant surcharge program is activated — reducing net processing costs while keeping operations simple and transparent for staff and customers alike.

How It Works

1. Sign Up & Configure Your Surcharge

Choose the surcharge percentage that reflects your true cost of acceptance (up to the legal maximum, usually 3%). Our team helps ensure your surcharge strategy complies with card network rules.

2. Display Transparent Notices

Clear signage and checkout disclosures keep your customers informed before they finalize a purchase.

3. Automated Processing & Reporting

PayLow Pro’s platform calculates and applies surcharges to eligible transactions automatically — with detailed reporting and reconciliation tools built into your dashboard.

4. Full Support & Compliance Resources

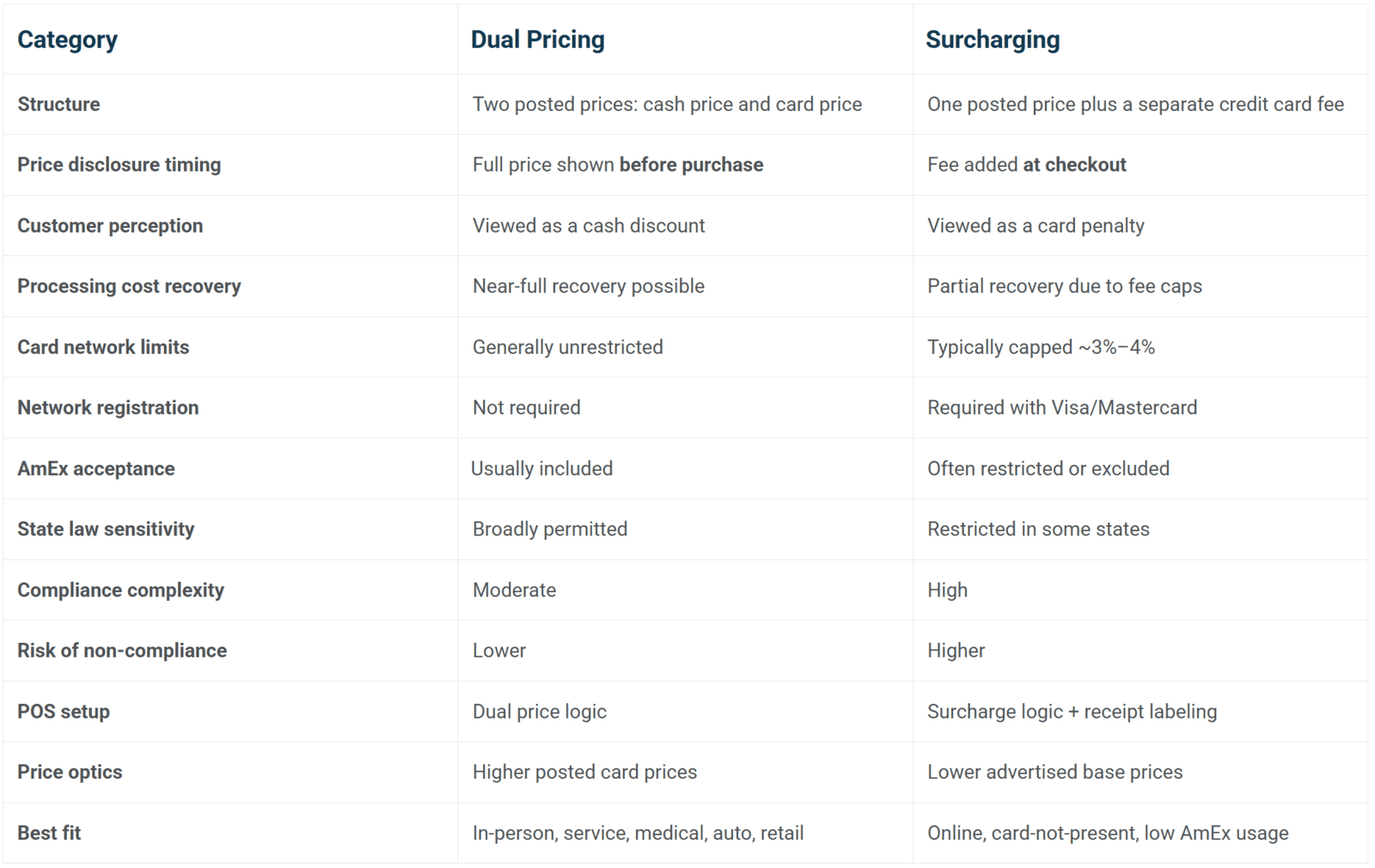

Surcharging vs Dual Pricing - What's the best fit?

Best-Fit Use Cases

Dual Pricing tends to fit best when:

- The merchant wants maximum cost recovery

AmEx acceptance is important

The business prefers simple compliance

In-store pricing transparency matters (retail, service, medical, auto)

Surcharging tends to fit best when:

Online or card-not-present volume is high

The merchant wants lower advertised prices

AmEx is minimal or can be excluded

The merchant can manage strict compliance requirements

Hear it from our community.

Hear it from our community.

"Easy 5 out of 5 stars for these guys!"

"Absolutely PHENOMENAL!"

Derek Lapis set up our practice with PayLo Procredit processing services. I thought real customer service was dead and a thing of the past but Derek came along and changed my mind! He was and is absolutely PHENOMENAL! He goes above and beyond just selling processing services! He keeps his promises and does exactly what he says he is going to do. When you call him, he picks up the phone every time. He always gets back to you when he says he will! Who does that today??? Well I will tell you who will….Derek Lapis! Derek is a rarity for sure! I can honestly say he has proved the best customer based service I have ever experienced in my 45 years of doing business! God bless you Derek!

-Dr. Michael Gulino

"PayLo Pro si the best credit card processor we've ever used."

PayLo Pro is the best credit card processor and cash tracker that we have ever used. Derek Lapis is our contact and he came to the office to train everyone and setup all the machines. Everything has worked flawlessly and every oral promise has been more than fulfilled. We use the PAX A920 with Wi-Fi and cell data. This works automatically when on farm calls and away from the office with no user input required to switch to cell data. We have not had one complaint about the NCA surcharge after talking with anyone that had questions. The SwipeSimple web app is fantastic at evaluating and summarizing all transactions before closing the batch. There have been no problems at all. We had great expectations and they have been exceeded. Thank you PayLo Pro and Derek Lapis for such a great product and service.

-Dr. Timothy Lesch

"Saving upwards of $500-$700 per month!"

-Dr. Iggy Pfaff

"Couldn't be happier!"

My precious vendor was impossible to contact without having to stay on hold for an eternity. They made PCI extremely difficult because of all the forms that had to be completed. POS equipment was also expensive. This is now my second month with PayLo Pro. Couldn’t be happier! Derek is always available if we have questions. Very easy transition!

- Jeff and Nancy Thomas

"Makes my staff's life easier."

- Theresa Peters

Get Started Today

Get Started Today

Your path to better payment processing is just a conversation away. Contact us today to see what PayLowPro can do for you.